by Sauleha Kamal

With In the New Century: An Anthology of Pakistani Literature in English, Muneeza Shamsie, the time‑tested chronicler of Pakistani writing in English, presents what is arguably the definitive anthology in this genre. Across her collections, criticism, and commentary, Shamsie has chronicled, championed, and clarified the growth of a literary tradition that is vast but, in many ways, still nascent. If there is one single volume to read in order to grasp the breadth, complexity, and sheer inventiveness of Pakistani Anglophone writing, it would be this one.

With In the New Century: An Anthology of Pakistani Literature in English, Muneeza Shamsie, the time‑tested chronicler of Pakistani writing in English, presents what is arguably the definitive anthology in this genre. Across her collections, criticism, and commentary, Shamsie has chronicled, championed, and clarified the growth of a literary tradition that is vast but, in many ways, still nascent. If there is one single volume to read in order to grasp the breadth, complexity, and sheer inventiveness of Pakistani Anglophone writing, it would be this one.

Comprehensive and weighty in the best sense, In the New Century is a tome, and unapologetically so. It almost asks readers to peruse it at a leisurely pace, giving the vastness of its subject matter, picking up and sitting with one writer at a time to uncover new dimensions to this genre. Spanning the work published between 1997-2017 by over eighty writers with least one full-length published collection in that period, the book, a follow up to her first anthology A Dragonfly in the Sun: An Anthology of Pakistani Writing in English (1997) proceeds in a loose chronological order according to the year of the author’s birth. This structure allows the reader to trace patterns across decades: the repetition of certain national traumas, the evolution of form and the confusing task of carving an identity. Each writer’s entry is prefaced by a concise biographical note which provides crucial context about their lives. This framing device is characteristic of Shamsie’s editorial approach: informed, unobtrusive, and generous. It also allows Shamsie to share priceless bits of trivia with readers, for example, that the Marxist writer Tariq Ali inspired Mick Jagger’s “Street Fighting Man.”

The first half of the anthology, in particular, feels like a trove of hidden gems, with stories, essays, and poems by a generation of writers who have shaped the tradition but are too often left out of mainstream discussions today. Only someone with Shamsie’s archival instinct and literary memory could have assembled such a list.

Recurring concerns of the Pakistani experience—displacement, migration, identity and inequality—echo across time. Some older pieces that capture the resilience that defines Pakistan are uncanny in that they feel as if they could have been written in the contemporary moment. Zulfikar Ghose’s “Silent Birds” is one such poem, masterfully capturing the contradictions of life in Lahore going on as normal amid extreme incidents like terrorist attacks. Taufiq Rafat’s poem “Karachi ‘79” captures the paradox of a city built for chaos (“My relatives here/ have had to be evacuated/ by a naval boat./ When they planned this city/ they forgot the sewers”). The city’s stubborn survival set against the ongoing human consequences of a lack of urban planning still rings true. Abdullah Hussein’s “Émigré Journeys,” which recounts the story of a modest villager making up his mind to migrate to England motivated for the promise of “bright prospects,” strikes a sad chord amid today’s headlines of ICE raids in the US and Afghan refugee expulsions in Pakistan. Read more »

In my last

In my last

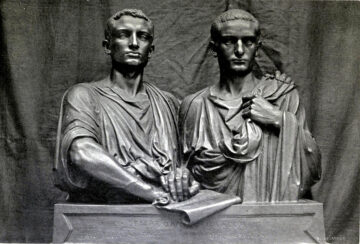

In the first part of this column last month, I set out the ways in which the separation of powers among the three branches of American government is rapidly being eroded. The legislative branch isn’t playing its part in the system of “checks and balances;” it isn’t interested in checking Trump at all. Instead it publicly cheers him on. A feckless Republican Congress has essentially surrendered its authority to the executive.

In the first part of this column last month, I set out the ways in which the separation of powers among the three branches of American government is rapidly being eroded. The legislative branch isn’t playing its part in the system of “checks and balances;” it isn’t interested in checking Trump at all. Instead it publicly cheers him on. A feckless Republican Congress has essentially surrendered its authority to the executive.

I drive in silence these days. That in itself is nothing new. For years, my solo road trips across America have featured long stretches of near silence. Nothing coming from the speakers. No talk, no music, no pleading commercials. Just the whir of the road helping to clear my mind.

I drive in silence these days. That in itself is nothing new. For years, my solo road trips across America have featured long stretches of near silence. Nothing coming from the speakers. No talk, no music, no pleading commercials. Just the whir of the road helping to clear my mind.

Junya Ishigami. Serpentine Gallery Pavilion, 2019.

Junya Ishigami. Serpentine Gallery Pavilion, 2019.

By many measures wealth inequality in the US and globally has increased significantly over the last several decades. The number of billionaires has increased at a staggering rate. Since 1987, Forbes has systematically verified and counted the global number of billionaires. In 1987, Forbes counted 140. Two decades later Forbes tallied a little over 1000. It counted 2000 billionaires in 2017. In 2024 it counted 2,781, and in March this year it counted 3,028 billionaires (a 50% increase in the number of billionaires since 2017 and almost a 9% increase since 2024).

By many measures wealth inequality in the US and globally has increased significantly over the last several decades. The number of billionaires has increased at a staggering rate. Since 1987, Forbes has systematically verified and counted the global number of billionaires. In 1987, Forbes counted 140. Two decades later Forbes tallied a little over 1000. It counted 2000 billionaires in 2017. In 2024 it counted 2,781, and in March this year it counted 3,028 billionaires (a 50% increase in the number of billionaires since 2017 and almost a 9% increase since 2024).