by R. Passov

Modeling in finance is done through the lens of mathematics. To put something into a model where you are not guided by observable constants, such as the speed of light, requires assumptions.

With so many models off the shelf a common understanding of assumptions is slipping by. If you go far enough back, most good finance text books bothered to explain the assumptions underlying the model. One such text – Modern Finance by Copeland and Weston – offers a comprehensive discussion of the assumptions necessary to argue that the world of asset pricing is mean-variant efficient (MVE.)

MVE underpins the Capital Asset Pricing Model (CAPM), the second most important model in all of finance; a model most students in business classes in western universities are exposed to; and something that simply can’t work. Much can be proven about what the model can say.

The most important of which is that there’s a certain portfolio of assets – the Efficient Frontier – that is better than all others.

But it turns out that while this portfolio can always be found in historical data, it can never be identified in the present.

But there are other models which can be derived from the same set of unrealistic assumptions. In 1997, The Nobel Prize committee awarded the prize in Economic Sciences to Robert Merton and Myron Scholes for their “… method to determine the value of derivatives,” – the Black Scholes Options Pricing Model (BS).

These two, along with Fisher Black who had passed prior to the award, solved the puzzle of pricing the right which affords its holder a specific time frame within which to purchase, for a set price, a risky asset. The right can be to buy (a call) or sell (a put) or otherwise manipulated in almost any fashion that mathematics allows, and still some form of the BS equation will arrive at a price.

The assumptions necessary for the options pricing model to mirror reality have never been met. And yet, pricing options and the reams of creative derivatives that spew forth is a several-hundred-trillion-dollar market.

The notional value of derivatives collapse, or ‘net,’ to a much smaller number as most activity is part of a giant zero-sum game. Still, options exist. Farmers have long since contracted in advance to sell yet-to-be harvested crop. It’s only in the past 45 years that a workable formula has been available to help someone negotiate a price.

The basic formula was derived in 1900 by a French mathematician. Read more »

Violence : War :: Lies : Mythology

Violence : War :: Lies : Mythology

That Fifties-looking gent to your right is John J. Sparkman (D-Alabama) who was Adlai Stevenson’s running mate in 1952. Sparkman served in Congress for more than 40 years, the last 32 of them in the Senate. While not a star, he was associated with several pieces of important legislation and became Chair of the Senate Banking Committee and, late in his career, the Senate Foreign Relations Committee. He was also a committed segregationist and, in 1956, signed the Southern Manifesto, in emphatic opposition to Brown vs. Board of Education.

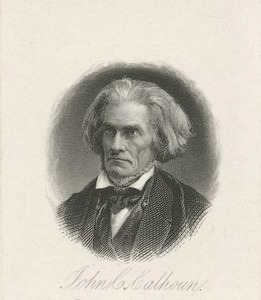

That Fifties-looking gent to your right is John J. Sparkman (D-Alabama) who was Adlai Stevenson’s running mate in 1952. Sparkman served in Congress for more than 40 years, the last 32 of them in the Senate. While not a star, he was associated with several pieces of important legislation and became Chair of the Senate Banking Committee and, late in his career, the Senate Foreign Relations Committee. He was also a committed segregationist and, in 1956, signed the Southern Manifesto, in emphatic opposition to Brown vs. Board of Education. This scary-looking guy to your left is John C. Calhoun of South Carolina, who, during a truly extraordinary career that included being a Congressman, Senator, Secretary of State, and Secretary of War, also managed to sneak in two terms as Vice President under two very different Presidents, John Quincy Adams and Andrew Jackson. You are going to hear a lot over the next few weeks about “chemistry” between Joe Biden and his running mate. Suffice it to say that John C. Calhoun never had chemistry with anyone, except perhaps of the combustible kind. Mr. Jackson and Mr. Calhoun disagreed constantly, particularly on the enforcement of federal laws that South Carolina found not to its liking (including the juicily named “Tariff of Abominations”), which led Mr. Calhoun to resign the Vice Presidency during the Nullification Crisis in 1832.

This scary-looking guy to your left is John C. Calhoun of South Carolina, who, during a truly extraordinary career that included being a Congressman, Senator, Secretary of State, and Secretary of War, also managed to sneak in two terms as Vice President under two very different Presidents, John Quincy Adams and Andrew Jackson. You are going to hear a lot over the next few weeks about “chemistry” between Joe Biden and his running mate. Suffice it to say that John C. Calhoun never had chemistry with anyone, except perhaps of the combustible kind. Mr. Jackson and Mr. Calhoun disagreed constantly, particularly on the enforcement of federal laws that South Carolina found not to its liking (including the juicily named “Tariff of Abominations”), which led Mr. Calhoun to resign the Vice Presidency during the Nullification Crisis in 1832. They hauled us all in bas minis from the ranger station to the trailhead. From there, a six-kilometer trail led up to our destination, the Laban Ratah guest house, at 11,000 feet. At 13,432 feet, Mt. Kinabalu’s summit, in Malaysian Borneo, is the highest point in Southeast Asia.

They hauled us all in bas minis from the ranger station to the trailhead. From there, a six-kilometer trail led up to our destination, the Laban Ratah guest house, at 11,000 feet. At 13,432 feet, Mt. Kinabalu’s summit, in Malaysian Borneo, is the highest point in Southeast Asia.

The word “interpretivism” suggests to most people a particularly crazy sort of postmodern relativism cum skepticism. If our relations to reality are merely interpretive and perspectival (I will use these terms interchangeably as needed, the idea being that each

The word “interpretivism” suggests to most people a particularly crazy sort of postmodern relativism cum skepticism. If our relations to reality are merely interpretive and perspectival (I will use these terms interchangeably as needed, the idea being that each

Stefany Anne Golberg’s

Stefany Anne Golberg’s

As we continue to distance ourselves from others in the midst of the new coronavirus pandemic, we hear about other people’s new rituals and routines as we formulate our own. As each day to be spent at home stretches (looms) ahead of us when we awake in the morning, rituals give the day shape, symmetry, a framework. What significance do these new rituals have for us individually and as a society? What did the old rituals mean? What if we were to take an anthropological approach to our own predicament?

As we continue to distance ourselves from others in the midst of the new coronavirus pandemic, we hear about other people’s new rituals and routines as we formulate our own. As each day to be spent at home stretches (looms) ahead of us when we awake in the morning, rituals give the day shape, symmetry, a framework. What significance do these new rituals have for us individually and as a society? What did the old rituals mean? What if we were to take an anthropological approach to our own predicament?

Our society needs virologists. Heeding their advice is valuable and consequential. In the Coronavirus pandemic, German politicians listened to the virologists, and Germany is doing relatively well. Other political leaders have (too long) ignored the virologists, and their citizenry is paying a high price.

Our society needs virologists. Heeding their advice is valuable and consequential. In the Coronavirus pandemic, German politicians listened to the virologists, and Germany is doing relatively well. Other political leaders have (too long) ignored the virologists, and their citizenry is paying a high price.