Kate Aronoff in The New Republic:

Kate Aronoff in The New Republic:

Five hours into the hearing in Marshall, Texas, moods were devolving fast. “I’ve got rural folks that are sick of seeing solar farms going up on every good piece of ranchland,” growled Texas state Senator Brian Birdwell, hunched over a long wooden dais. Like most of his colleagues, he was gray-haired, drab-suited, ill-humored. Filtering in through a row of tall windows at Birdwell’s back, the December light did little to brighten the atmosphere. “Maybe that’s why we’re gonna be eating insects instead, cause there’s nowhere for the cattle to graze.”

The Texas state Senate State Affairs Committee was considering neither alternative protein sources nor land use. Birdwell and his colleagues were gathered at the Old Harrison County Courthouse to determine whether the asset managers they’d summoned before them—gargantuan companies charged with profitably investing trillions of dollars on behalf of their clients, including the state of Texas—were complying with the demands of a bizarre new law. Passed in 2021, Senate Bill 13 requires Texas to cut off business ties to financial firms deemed to be boycotting energy companies for ideological reasons. The law was just one front in a proxy battle between the Republican Party and three letters newly in its crosshairs: ESG.

The acronym, which stands for “environmental, social, governance,” refers to criteria investors use to determine the impact potential investments may have on the world, as well as calculate how events in the world may affect investments. It can describe financial products crafted to perform well according to those criteria, or strategies corporations adopt to do so. While its meaning is nothing if not fuzzy, the term is often shorthand for climate- and socially conscious investment.

More here.

Kate Aronoff in The New Republic:

Kate Aronoff in The New Republic: James K. Galbraith in The Nation:

James K. Galbraith in The Nation: Max Gallien and Giovanni Occhiali in Sidecar:

Max Gallien and Giovanni Occhiali in Sidecar: P

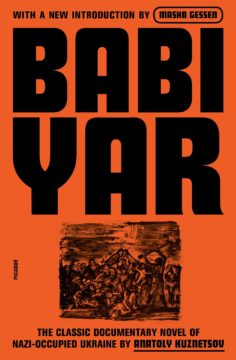

P On Sept. 29 and 30, 1941, in a ravine just outside Kyiv called Babyn Yar (“Babi Yar” in Russian), Nazis executed nearly 34,000 Jews over the course of 36 hours. It was the deadliest mass execution in what came to be known as the “Holocaust by Bullets.” We were never supposed to know it happened. In 1943, as the Nazis fled Kyiv, they ordered the bodies in Babyn Yar to be dug up and burned, to erase all memory of what they’d done.

On Sept. 29 and 30, 1941, in a ravine just outside Kyiv called Babyn Yar (“Babi Yar” in Russian), Nazis executed nearly 34,000 Jews over the course of 36 hours. It was the deadliest mass execution in what came to be known as the “Holocaust by Bullets.” We were never supposed to know it happened. In 1943, as the Nazis fled Kyiv, they ordered the bodies in Babyn Yar to be dug up and burned, to erase all memory of what they’d done. W

W

The specter of being trapped in a world of illusions has haunted humankind much longer than the specter of A.I. Soon we will finally come face to face with Descartes’s demon, with Plato’s cave, with the Buddhist Maya. A curtain of illusions could descend over the whole of humanity, and we might never again be able to tear that curtain away — or even realize it is there.

The specter of being trapped in a world of illusions has haunted humankind much longer than the specter of A.I. Soon we will finally come face to face with Descartes’s demon, with Plato’s cave, with the Buddhist Maya. A curtain of illusions could descend over the whole of humanity, and we might never again be able to tear that curtain away — or even realize it is there. Between 1910 and 1940, thousands of Chinese immigrants were detained—sometimes for months—in facilities on Angel Island, off the coast of San Francisco.

Between 1910 and 1940, thousands of Chinese immigrants were detained—sometimes for months—in facilities on Angel Island, off the coast of San Francisco. A record outbreak of

A record outbreak of  The very deepest worries center around the question of AGI, Artificial General Intelligence, and the question of the Singularity. AGI is a form of artificial intelligence so advanced that it could understand the world at least as well as a human being in every way that a human being can. It is not too far a step from such a possibility to the idea of AGIs that can produce AGIs and improve both upon themselves and further generations of AGI. This leads to the Singularity, a point at which this production of super-intelligence goes so far beyond that which humans are capable of imagining that, in essence, all bets are off. We can’t know what such beings would be like, nor what they would do. Which sets up the alignment problem. How do you possibly align the interests of super intelligent AGIs with those of puny humans? And as many have suggested, wouldn’t a super intelligent self-interested AGI be rather incentivized to get rid of us, since we are its most direct threat and/or inconvenience? And even if super AGIs did not want to exterminate humans, what is to ensure that they would care much what happens to us either way?

The very deepest worries center around the question of AGI, Artificial General Intelligence, and the question of the Singularity. AGI is a form of artificial intelligence so advanced that it could understand the world at least as well as a human being in every way that a human being can. It is not too far a step from such a possibility to the idea of AGIs that can produce AGIs and improve both upon themselves and further generations of AGI. This leads to the Singularity, a point at which this production of super-intelligence goes so far beyond that which humans are capable of imagining that, in essence, all bets are off. We can’t know what such beings would be like, nor what they would do. Which sets up the alignment problem. How do you possibly align the interests of super intelligent AGIs with those of puny humans? And as many have suggested, wouldn’t a super intelligent self-interested AGI be rather incentivized to get rid of us, since we are its most direct threat and/or inconvenience? And even if super AGIs did not want to exterminate humans, what is to ensure that they would care much what happens to us either way? There are certain sweet-smelling, sugarcoated lies current in the world which all politic men have apparently tacitly conspired together to support and perpetuate. One of these is that there is such a thing in the world as independence: independence of thought, independence of opinion, independence of action.

There are certain sweet-smelling, sugarcoated lies current in the world which all politic men have apparently tacitly conspired together to support and perpetuate. One of these is that there is such a thing in the world as independence: independence of thought, independence of opinion, independence of action. Scientists who study happiness know that being kind to others

Scientists who study happiness know that being kind to others