Mark Blyth and Nicolò Fraccaroli at Project Syndicate:

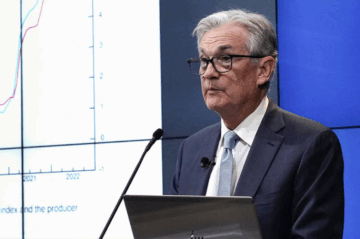

As its September meeting approaches, the US Federal Reserve is once again coming under political pressure to lower rates. President Donald Trump has been calling for such a move for months – sometimes demanding cuts as large as three percentage points – and openly attacking Fed Chair Jerome Powell and individual Fed board members.

As its September meeting approaches, the US Federal Reserve is once again coming under political pressure to lower rates. President Donald Trump has been calling for such a move for months – sometimes demanding cuts as large as three percentage points – and openly attacking Fed Chair Jerome Powell and individual Fed board members.

Trump’s main motive in pushing for lower rates is to reduce government borrowing costs, which have spiked because of near-term inflation fears and longer-term worries about the sustainability of US debt. But while US inflation has fallen markedly from its 2022 peak of over 9% to 2.9% today, it seems to be trending higher again, and that complicates the case for rate cuts.

Specifically, economists worry that rate cuts could reignite inflation, especially now that tariffs are applying upward pressure on import prices. Although the pass-through from tariffs to inflation has been weak so far, the latest data suggest that higher prices may finally be materializing. Under these circumstances, lowering rates when markets expect higher inflation could do the opposite of what Trump wants: rather than falling, the government’s borrowing costs would balloon further.

But notwithstanding that risk, cutting rates now is not a terrible idea. The reason has nothing to do with what Trump claims, and everything to do with the historical evidence and the imperative to maintain some degree of equity.

More here.

Enjoying the content on 3QD? Help keep us going by donating now.