by John Allen Paulos

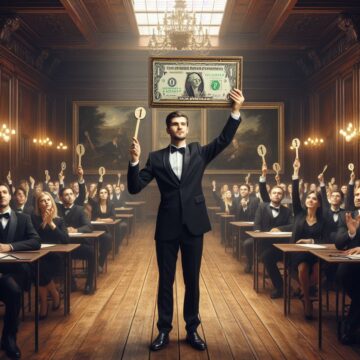

An abstract paradox discussed by Yale economist Martin Shubik has a logical skeleton that can, perhaps surprisingly, be shrouded in human flesh in various ways. First Shubik’s seductive theoretical game: We imagine an auctioneer with plans to auction off a dollar bill subject to a rule that bidders must adhere to. As would be the case in any standard auction, the dollar goes to the highest bidder, but in this case the second highest bidder must pay his or her last bid as well. That is, the auction is not a zero-sum game. Assuming the minimum bid is a nickel, the bidder who offers 5 cents can profit 95 cents if the no other bidder steps forward.

An abstract paradox discussed by Yale economist Martin Shubik has a logical skeleton that can, perhaps surprisingly, be shrouded in human flesh in various ways. First Shubik’s seductive theoretical game: We imagine an auctioneer with plans to auction off a dollar bill subject to a rule that bidders must adhere to. As would be the case in any standard auction, the dollar goes to the highest bidder, but in this case the second highest bidder must pay his or her last bid as well. That is, the auction is not a zero-sum game. Assuming the minimum bid is a nickel, the bidder who offers 5 cents can profit 95 cents if the no other bidder steps forward.

This can lead to an unexpected result. The bidder who begins with a nickel bet will likely be outbid by another bidder offering 10 cents for the dollar and thereby standing to reap a 90 cent profit if not outbid. This profit margin too would likely entice a bidder, maybe the first one, to offer 15 cents and score a profit of 85 cents. Now the bidder who bet 10 cents wants to keep from losing 10 cents and so is likely to up his bet to 20 cents. This continues as, at each stage, the bidders must wrestle with the issue of sunk costs and decide whether to give up or raise their bid for the dollar by 5 cents or more.

These bids are not irrational, but can nevertheless reach the one dollar mark. This will happen when one of the bidders bids 95 cents and another bids a dollar. The bidder offering 95 cents then faces a loss of 95 cents if he or she declines to bid $1.05. Declining may be unlikely, however, since bidding $1.05 would reduce their loss from 95 cents to only 5 cents, paying $1.05 for $1. These incentives will remain even as the bids exceed a dollar with no compelling natural limit. Second highest bidders, by definition, always lose more than the highest bidders yet gain nothing, and so always want to lessen their losses and gain something by becoming the highest bidder.

Of course, since the stakes are so low, players are likely to bow out early and not be ensnared by the game’s logic. A recent news story suggests, however, that something like the dollar auction game can have more visceral and deadly consequences. I’m referring to the recent back-and-forth battle for the eastern Ukrainian city of Avdiivka.

We can analogize the Russian and Ukrainian sides’ throwing more and more soldiers into the battle to the bidders offering more and more for a dollar. That the army sustaining the second highest number of battle losses will not capture the city is consistent with the rule that the auction’s second highest bidder must pay up despite having won nothing. (This is, of course, a simplifying assumption. An army with more soldiers will usually, but not always defeat one with fewer soldiers.)

There are strategies other than gradual escalation. For example, a bidder’s initial offering of 5 cents may be countered by an immediate offer of a dollar from another bidder. Likewise, a minor intrusion by one army may be countered by an all-out assault by the opposing army. These attempts to stun the opponent and quickly bring about an end to the game/battle can still fail if they’re countered by increasing bids or throwing in more soldiers.

Pennies are just pennies, whether bid in small steps or large, but in battle escalations lead to a higher and higher price in death and destruction. Not only in dollars, but also in dolors. Of course, war and social interactions are incomparably more complex than abstract games and comparing them may seem rather Pickwickian. Among the obvious differences is that neither bidder in the dollar game is blame-worthy nor does emotion play much of a role in the game. Nevertheless games do sometimes shed an oblique and dim light on war and social phenomena generally. As statistician George Box famously remarked, “All models are wrong, but some are useful.” I might add “or at least suggestive.”

***

John Allen Paulos is an emeritus Professor of Mathematics at Temple University and the author of Innumeracy and A Mathematician Reads the Newspaper. These and his other books are available here.