Adam Tooze debates Robert Armstrong and Ethan Wu on whether China can make the adjustments necessary to sustain growth. First, Tooze with a post at the FT’s Unhedged:

Adam Tooze debates Robert Armstrong and Ethan Wu on whether China can make the adjustments necessary to sustain growth. First, Tooze with a post at the FT’s Unhedged:

The common starting point for Chartbook and Unhedged is the view that as far as the world economy and financial markets are concerned China remains the big story.

This is not to say that Russia’s invasion of Ukraine is not a dramatic shock and the risk of escalation is not terrifying. The impact on energy and food prices will be felt worldwide. But China is a whale. A serious crisis and long-term slowdown there will affect every market and practically every economy worldwide. China is also far more deeply financially interconnected with the rest of the world economy than Russia and Ukraine. China’s economic growth is the driver of what it still the primary geopolitical antagonism in the 21st-century world, that between Beijing and Washington.

So the question of China’s growth prospects is a vital one both for policymakers and investors. And this is particularly urgent in light of the signs of serious stress in China’s economy and financial markets.

Armstrong and Wu in Tooze’s Chartbook:

Adam is clear-eyed about China’s challenges, but is optimistic that they can be overcome.

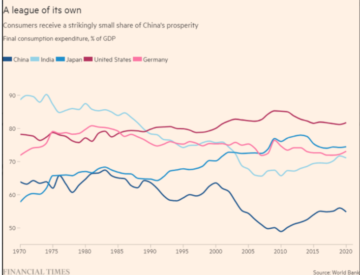

China’s investment-driven, debt-heavy development model needs replacement. Its geopolitical and economic position will become more precarious if the globe’s authoritarian and liberal democratic blocs decouple, a threat made vivid by the war in Ukraine. Its demographics will be a drag on growth. All of this is plain fact. But Adam sees reasons for hope:

- China’s technocrats have, to date, demonstrated competence in managing the economy’s imbalances. “By means of its ‘three red lines’ policy, [China] is stopping in its tracks the most dramatic accumulation of wealth in history … if Beijing manages to stop the largest property boom ever without a systemic financial crisis, it is setting an entirely new standard in economic policy.” Pricking bubbles before they burst and wreak economic havoc is exactly what the US has serially failed to do. “If we look in the mirror, why aren’t we applauding more loudly?” Adam asks.

More here.