Herman Mark Schwartz in American Affairs Journal:

Herman Mark Schwartz in American Affairs Journal:

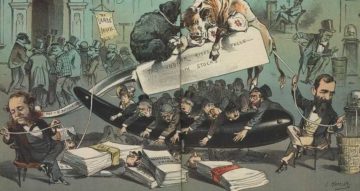

What exactly is financialization? How does it relate to what’s happening in the rest of the economy? Does it hinder growth, and if so, how? At the end of the nineteenth century, many on both the left and right regarded finance as a vampire sucking the lifeblood out of “real” businesses, workers, and, in Britain’s settler colonies, local economies. Indeed, Stanford literature professor Franco Moretti has argued that the classic 1897 Bram Stoker novel Dracula, which birthed the modern vampire mythos, reflected British manufacturers’ fears of competition from new American and central European firms (primarily German) backed by powerful banks. Contemporaneous and more prosaic American and German economists also observed how finance encompassed and encumbered nonfinancial firms. The final third of Thorstein Veblen’s still relevant Theory of the Business Enterprise (1904) dissects how U.S. financial elites used the stock market to consolidate and control industry. Shortly after, in 1910, the Marxist and later Weimar-era finance minister Rudolf Hilferding comprehensively analyzed banks’ preeminent power in the German economy.

One century later, the same debate and language has resurfaced. Matt Taibbi famously called Goldman Sachs “a great vampire squid wrapped around the face of humanity.” But with Hollywood totally dependent on financial firms to capitalize its increasingly expensive and risky gambles, the focus in popular culture has shifted from vampires to the zombie firms they leave behind—bloodless, battered, neither bankrupt nor bountiful, shuffling around aimlessly in search of better corporate governance that might restore them to their prior profitable state.

More here.