Adam Tooze in Foreign Policy:

Adam Tooze in Foreign Policy:

As [Mark] Carney laid it out back in 2015, three types of risk could strike the financial system: losses in the insurance system, climate change liability, and the problem of stranded assets.

The insurance system is the economy’s shock absorber. Its role is to spread the impact of losses from those immediately affected to those with the wherewithal to bear the shock. In good times, the insurers earn handsome returns for accepting this risk. They cover their own liabilities by taking out reinsurance, further spreading the losses.

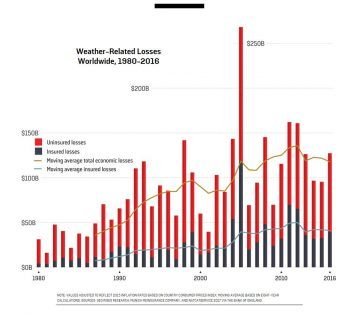

It is a highly effective system and enormous in scale. Property and casualty insurance (as distinct from life and health insurance) generates global premiums in excess of $1.5 trillion a year. The business is profitable so long as the risks remain within familiar limits and largely uncorrelated with each other. But that is precisely what climate change has called into question. As Carney put it in 2015, as a result of climate change, “the tail risks of today” will be “the catastrophic norms of the future.” Since the 1980s, the scale of weather-related insurance losses has risen fivefold to about $55 billion a year. Uninsured losses are twice as much again.

In theory, the costs due to this shift in risk profiles should be capable of being contained within the insurance sector itself. But as the fate of AIG made painfully apparent in 2008, insurance firms are key nodes in the global financial system. The money accumulated by the insurers is reinvested in money markets, banks, and other funds. Nine major insurers are listed as globally systemically important by the Financial Stability Board. They are too big to fail.

More here. Also see this response by Tooze to the Bundesbank’s reaction to his piece.