Barbara Kollmeyer in MarketWatch:

Our call of the day, pulls no punches as it warns that all that oft-referenced increase in affluence, has been artificially inflated by the Fed, which is ultimately bad news for the economy and the stock market. Here’s how Jesse Colombo, analyst at Clarity Financial, explains it:

“The U.S. household wealth boom since the Great Recession is a sham, a farce and a gigantic lie that is tricking everyone into believing that happy days are here again even though the engines that are driving it are bubbles that are going to burst and cause a crisis that will be even worse than the 2008 crash,” Colombo said in a video he posted via the Real Investment Advice blog.

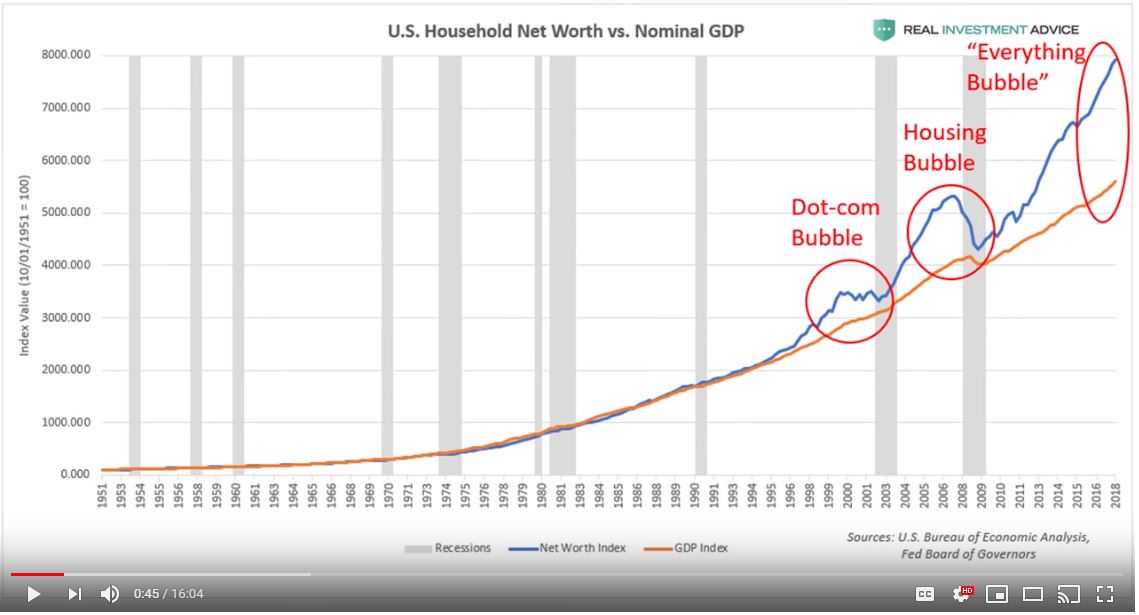

There has been a fair bit of buzz on the topic since data this summer that showed household wealth topped $100 trillion for the first time in June. Colombo’s isn’t the only invective against bloated U.S. wealth and how it could go terribly wrong, but the commentary delivers, perhaps, the most potent argument to date, including charts, such as the following, that illustrates the degree to which wealth has been outpacing economic expansion:

Wealth that gallops past economic growth is a “telltale sign that the boom is artificial and unsustainable, he said. The last two times the share of household-wealth growth exceeded gross domestic product, or GDP, was during the late 1990s dot-com bubble and the mid-2000 housing bubble, he notes. “Both of which ended in tears,” he said.

More here.