by R. Passov

This will be one of the most important compounds of our generation. —Jeff Kindler, former CEO, Pfizer, commenting on Torcetrapib

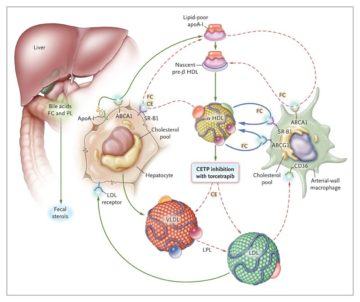

Failure of a drug in development, especially in a late stage clinical trial, is  shocking. Torcetrapib, for example, failed at the very end of its phase III trial. So many resources had been expended to get that far in development. Everything spent was lost. All that remained was a big data pile worth virtually nothing, along with pilot plants that were built to supply the drug to thousands of patients across years of clinical trials.

shocking. Torcetrapib, for example, failed at the very end of its phase III trial. So many resources had been expended to get that far in development. Everything spent was lost. All that remained was a big data pile worth virtually nothing, along with pilot plants that were built to supply the drug to thousands of patients across years of clinical trials.

The high cost of failure is why big rewards are offered to underwrite the risk of drug development. But because the costs of failure are so high, you have to be careful not to over-reward success. This is can happen rather too easily when the odds of success are relatively immutable with respect to the amount of money spent in search of success. And when the prize money continues to grow.

When you have these circumstances the incentives to take risks grow to the point where the amount of risk taken is excessive leading to repeated failures and wastage. How does this happen? When, given success, there is too much pricing power; too much power such that the profits the industry generates fall into the realm of what economists term ‘rent’ vs true profits that result from increasing overall social welfare. (See Garthwaite.)

Excessive pricing power, some argue, also contributes to the illusion that the risks of drug development, crudely measured as the average cost of failure, continue to rise. (See Garthwaite.) A simple analogy might be movie production: If you triple the production budget across the industry, what’s clear is that the input costs of movie-making will rise. What’s less clear is whether the movies made will be well received by critics and fans. In a similar manner, pricing power in the biopharma industry may be a significant contributor to the ongoing increase in the average cost of development.

In every developed country other than the US, drugs must gain access to a national formulary. So in effect, the government negotiates price. In the US, in general, pricing is left to a market whose complexity borders on undecipherable. However, based on the simple observation that spending on medicines in the US, on a per capita basis, is a multiple of the average spend in developed countries, it’s plausible to argue that the biopharma industry in the US exhibits economic rent – an extraction of rewards that exceeds the overall societal benefit.

* * *

Drug development tends to take place in economies where the rewards for success and protections on Intellectual Property (IP) are sufficient.

If we divide the search for cures into two rudimentary steps – discovery (looking for the small molecule or protein) and development (running clinical trials in search of necessary approval data) – then while both IP protection and sufficient rewards are necessary for development, it’s likely not a strong argument that such is the case for discovery.

For discovery is the science (or in the case of Biotech – it’s the technology as that’s become the science). And while scientists are as motivated by financial rewards as the rest of us, they are also driven by inspiration and the pure need to discover and so, as is the case with say musicians who in the absence of the promise of royalties would still make music, so would scientists want to yell about their discoveries in peer reviewed journals.

But if you desire to take a discovery through the process of development, you’ll want protection. If you’ve worked years toward a discovery or luckily licensed something from a university laboratory, you will need protection for your current and future investments. Without such, you will not be able to rationalize the extraordinary financial burdens and risks that await the process of development.

For as the case with Torcetrapib shows, drug development is expensive and late failures, catastrophic: Exorbitant losses coupled with virtually useless assets.

Patents are meant to facilitate the development of ideas that, absent some form of intellectual property (IP) protection, would otherwise likely not come into being. The attributes of something that relies extensively on IP for its existence are typically significant costs of development coupled with low marginal costs of production.

Once such an asset has been developed, it’s relatively easy to be copied. Absent IP protection, a freely competitive market place is not likely to result in pricing that adequately rewards the risks of development. And thus societies, at least since the 1400’s, have developed various schemes of IP protection.

IP protection serves to commodify an asset. That is, by restricting access, it facilitates rationing through a market place. The benefits to society are presumed to exceed the costs imposed from rationing.

* * *

Patent length in the United States is twenty years from time of filling of the New Chemical Entity or Biological plus potential extensions depending on certain choices in the clinical trial process. But since development can consume a considerable portion of the patent life, effective patent life affords anywhere from say five to twelve or so years of marketing exclusivity (ignoring the possibility of extensions through clever lawyering.) This means that the innovator is in possession of sole pricing power, and sole control over the data attendant to the particular treatment.

In exchange for conferring this protection, US consumers get a few benefits: The treatment itself, which arguably may not have been developed or likely would have been developed over a much longer time frame; early access to the treatment for individuals fully insured or otherwise of means and after the patent expires, access in perpetuity at a cost that in many cases will approach the marginal cost of production.

So, a generally available antibiotic that’s off-patent but still effective against what otherwise could be a deadly pneumonia can cost as little as ten dollars per life-saving treatment while an on-patent cancer treatment that results, on average, in six months of progression free survival (lack of tumor growth), but no change in overall survival, can cost in excess of $250k per treatment.

Insurance offers some protection to the individual against the full exploitation of the value of the cure. But insurance does not protect the total social welfare from miss-appropriation. In fact, while for-profit insurance can guarantee access to medicines whose prices are in the millions of dollars per treatment, for-profit insurance also participates in facilitating such pricing.

* * *

In our current climate, the for-profit pharma industry has a dilemma: New Science is rushing into place a viable prophylactic for C-19; but how should access be priced?

While pricing power may have accelerated the development of key technologies, rationing access to a vaccine by way of price is at odds with the social welfare derived from vaccines.

A vaccine distribution program exhibits both negative externalities – choosing against vaccination harms others – and positive externalities – the greater the number of vaccinations the more effective is the overall vaccination program.

What is the right price of a vaccine? Given the positive externalities, who should bear liability for adverse reactions? In times of national crises, how should companies be compensated where appropriation of patents is deemed the most effective path forward? These have been difficult to answer questions that have negatively impacted on the incentives to develop vaccines likely to be mandatory.

Alternatives to patent schemes have been proposed. Senator Sanders, for example, in 2006 proffered his Medical Innovation Prize Fund Act which proposed to reward drug discovery and development through a scheme of prizes as opposed to market exclusivity. (see Muzaka.)

As Muzaka and others note, a patent is not a natural right; rather it is a construct meant to create an incentive to produce goods so that society gains a benefit in excess of costs. Looked at in this manner, it’s reasonable to expect that the tenets of patent law be re-assessed from time-to-time to ensure the contract is meeting objectives. Especially as terms of exclusivity granted under patents are ‘one size fits all’ and not tied to a progressive understanding of the actual risks incurred.

The US government has committed billions of dollars toward advanced purchase commitments of prospective C-19 vaccines. Such underwriting of risks, when looked at in hindsight, may partially prove the case for alternative drug development schemes while highlighting the need for some exercise of purchasing power.

In these times of Covid, we are watching a giant experiment, not just in technologies of drug discovery but in the pricing of success. Two of the leading vaccine candidates in the West are applications of ‘mRNA’ technologies. Both are likely to be either first or near-first applications of this technology. If successful this technology may, or may not, prove the merits of the Bio-Pharma industry’s argument that freedom-to-price – as is the case in the US – leads to the best of all outcomes.

***

References

The Torcetrapib Catastrophe; D. Lowe. Science Translational Medicine. December 3rd, 2006

Insurance and the High Prices of Pharmaceuticals; D. Besanko, D. Dranove, C. Garthwaite. Working Paper 22353. NBER. June 2016

Prizes for Pharmaceuticals? Mitigating the Social Ineffectiveness of the Current Pharmaceutical Patent Arrangement. V Muzaka – Third World Quarterly, 2013