Over at his Chartbook newsletter, Adam Tooze explores how stable is the financial system?

Over at his Chartbook newsletter, Adam Tooze explores how stable is the financial system?

At least twice a year, the world’s central banks and international financial institutions like the IMF and the Financial Stability Board set themselves to answering this question. A typical rhythm is to publish two reports a year, one in the spring and one in the autumn. National central banks cover their respective territories. The IMF and the Financial Stability Report take a global view. In the last few weeks, we have had the reports from the IMF, the Fed and the ECB. The Bank of England does a very interesting report. So too does the Bank of Japan.

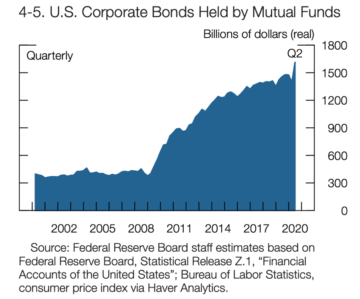

These are rich documents, stuffed with data, charts and commentary, a treasure trove for us to plunder for months on end. For today’s newsletter I thought it would be interesting to compare the reports issued by the Fed, the ECB and the IMF as documenting different points of view at this dramatic moment in the development of the world economy.

The Fed’s report breathes the air of 2008 and Dodd-Frank. It is an elegant, stripped down document that focuses on the essentials of financial stability i.e. credit risks arising from loans made to businesses and households and funding risks arising from the sources of funding used by banks, investment funds and insurers. The commentary is sparse. The Fed presumably does not want to give too much away. Nor does it want to find itself in hot political water.

More here.