Herman Mark Schwartz in Phenomenal World:

Herman Mark Schwartz in Phenomenal World:

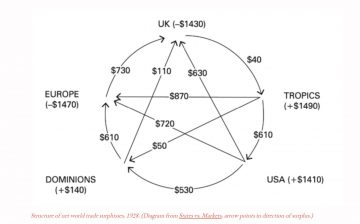

What does the US dollar’s continued dominance in the global monetary and financial systems mean for geo-economic and geo-political power? In a recent article, Yakov Feygin and Dominik Leusder question whether the United States actually enjoys an “exorbitant privilege” from the global use of the USD as the default currency for foreign exchange reserves, trade invoicing, and cross-border lending. Like Michael Pettis, they argue that the dollar’s primacy actually imposes an exorbitant burden through its differential costs on the US population.

Global use of the dollar largely benefits the top 1 percent of wealth holders in the United States, while imposing job losses and weak wage growth on much of the rest of the country. This situation flows from the structural requirements involved in having a given currency work as international money. As Randall Germain and I have argued in various venues, a country issuing a globally dominant currency necessarily runs a current account deficit.1 Prolonged current account deficits erode the domestic manufacturing base. And as current account deficits are funded by issuing various kinds of liabilities to the outside world, they necessarily involve a build-up of debt and other claims on US firms and households.

A large share of those foreign claims are on US firms in the form of corporate equity. US holdings of foreign firms’ equity are roughly equal in size, but these are largely held by the top 1 percent. The bulk of US debt to the rest of the world is public and private debt, including securitized mortgages. As the top 1 percent largely avoid taxation, the broad US public is on the hook for those debts. The rich reap the rewards of dollar dominance in the form of financial rents and easier tax avoidance. Meanwhile, the rest of us compete against artificially cheap low wage imports while struggling to find affordable housing.

More here.