Tega Brain and Sam Lavigne in e-flux Architecture:

Carbon offsetting injects market logic into thin air. It demands that certain activities become measured and standardized, reduced to the single dimension of the carbon dioxide molecule. The goal is fungibility—to assert equivalence between activities by people or environments so that emissions created over here can be traded and (theoretically) compensated for by actions removing or reducing carbon over there. The means is, of course, commodification. Offsets privatize planetary metabolism.

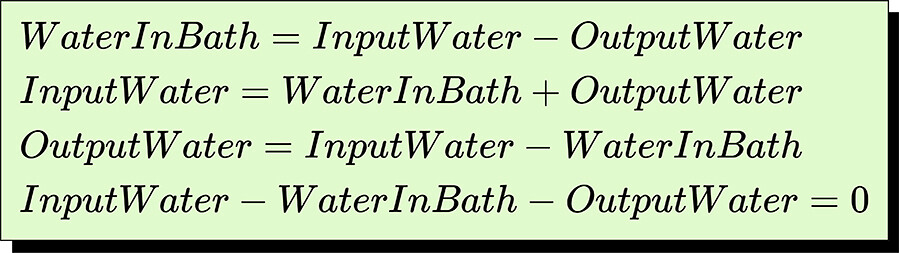

Offsetting is the logic behind “net zero.” “Think about it like a bath,” suggests National Grid. “The amount of water in the bath depends on both the input from the taps and the output via the plughole. To keep the amount of water in the bath at the same level, you need to make sure that the input and output are balanced.”1 Or, as McKinsey & Company puts it: “Net zero is an ideal state where the amount of greenhouse gasses released into the earth’s atmosphere is balanced by the amount of greenhouse gasses removed.”2

Policymakers and corporations around the world have embraced the concept of net zero as a pathway to address the climate crisis. Nation states, corporations, public institutions, and even art exhibitions purchase offsets as financial assets (called carbon credits) in an attempt to compensate for their emissions and reach a state of carbon neutrality. Traded as financial commodities on carbon markets, offsets are supposed to represent either carbon dioxide reductions—via avoided emissions that would have otherwise happened in a business-as-usual scenario—or carbon dioxide removals—where some of the carbon already hanging about in the atmosphere is drawn down.

More here.

Enjoying the content on 3QD? Help keep us going by donating now.