Cedric Durand in Sidecar:

Cedric Durand in Sidecar:

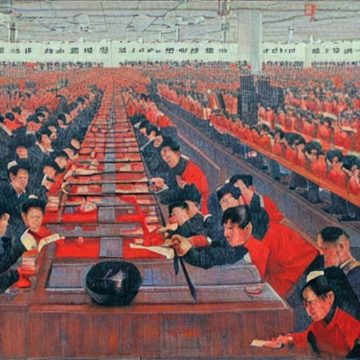

The return of industrial policy is unmissable, catalyzed by the cumulative shocks of Covid-19 and the war in Ukraine as well as longer-term structural issues: the ecological crisis, faltering productivity and alarm at the dependence of Western states on China’s productive apparatus. Together, these factors have steadily undermined governments’ confidence in the ability of private enterprise to drive economic development.

Of course, the ‘entrepreneurial state’ never disappeared, especially in the US. The deep pockets of the Defense Advanced Research Projects Agency and the National Institutes of Health have been crucial in maintaining the country’s technological advantage – funding research and product development over the past few decades. Still, it is clear that a substantial shift is taking place. As a group of OECD economists noted, ‘So-called horizontal policies, i.e. interventions available to all firms and which include business framework conditions such as taxes, product or labour market regulations, are increasingly questioned’. Meanwhile, ‘the case for governments to more actively direct the structure of the business sector is gaining traction’. Hundreds of billions of targeted funding is now flooding businesses in the military, high-tech and green sectors on both sides of the Atlantic.

This pivot is part of a broader macro-institutional reconfiguration of capitalism, in which a high-pressure post-pandemic economy has tightened labour markets while the centrality of finance continues to wane. These phenomena are highly complementary: public funding stimulates the economy and may boost job creation, while the administrative allocation of credit serves as an admission that financial markets are unable to attract the investment necessary to meet major conjunctural challenges. At a very general level, this neo-industrial turn should be welcomed, since it implies that political deliberation may play a somewhat greater role in investment decisions. More concretely, though, there is much to worry about.

More here.