Adam Tooze over at his substack:

Adam Tooze over at his substack:

Sanctions are the chosen weapon of the West against Putin’s aggression.

Rather than starting small we have gone immediately to an attack on the central bank.

In response, the Russian central bank has effectively stopped capital flows our of Russia and nationalized foreign exchange earnings of major exporters. It now requires Russian firms to convert 80 percent of the dollar and euro earnings into rouble. This helps to bolster the rouble’s value and provides a flow of foreign exchange into the country.

The “well-respected” i.e. highly conservative leadership of the Bank of Russia immediately raised rates and adopted the full array of central bank interventions that one might expect, pumping liquidity into the banking system and easing capital requirements. Reading the central bank’s website is a surreal experience – post-2008 style “macroprudential buffers” in the service of stabilizing Putin’s home front.

The question now, is how severe do we expect the impact of sanctions to be. How rapidly will they act? How will they impact Russian society and how might they change it politics?

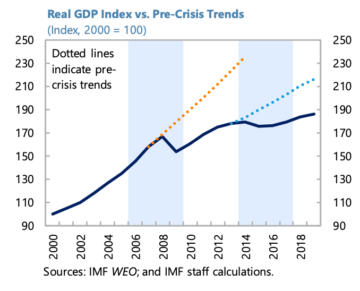

It is tempting to think about this in terms of the effects on exports, efficiency, long-term damage to economic growth etc. The outlook for Russia is surely grim. The sanctions will further worsen a growth-rate which, since Crimea, has already been depressed.

More here.