Simon Torracinta in the Boston Review:

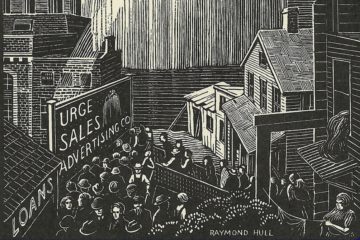

“Those who can, do science,” the economist Paul Samuelson once remarked. “Those who can’t, prattle on about methodology.” Until fairly recently this seemed to be the dominant attitude among mainstream economists, but a sea change came when the global financial system began to unravel in 2007. In the decade and a half since—painful years of sluggish recovery, stagnating real wages, yawning inequality, and populist upheaval—reflexive talk has exploded. Why was the crash not widely predicted? Was the “efficient market hypothesis” to blame? Have lessons from the Great Depression been forgotten? And why are core questions about finance, power, inequality, and capitalism still largely missing from Economics 101?

“Those who can, do science,” the economist Paul Samuelson once remarked. “Those who can’t, prattle on about methodology.” Until fairly recently this seemed to be the dominant attitude among mainstream economists, but a sea change came when the global financial system began to unravel in 2007. In the decade and a half since—painful years of sluggish recovery, stagnating real wages, yawning inequality, and populist upheaval—reflexive talk has exploded. Why was the crash not widely predicted? Was the “efficient market hypothesis” to blame? Have lessons from the Great Depression been forgotten? And why are core questions about finance, power, inequality, and capitalism still largely missing from Economics 101?

The most visible debates have centered on macroeconomics—the study of the gross features of the economy as a whole. At stake are some of the field’s bedrock concerns: the power of public spending and money creation, the role of banking and the risks of complex financial instruments, the relationship between employment, wages, inflation, and interest rates, and the nature and necessity of growth.

More here.