James Meadway in Progressive Economy Forum:

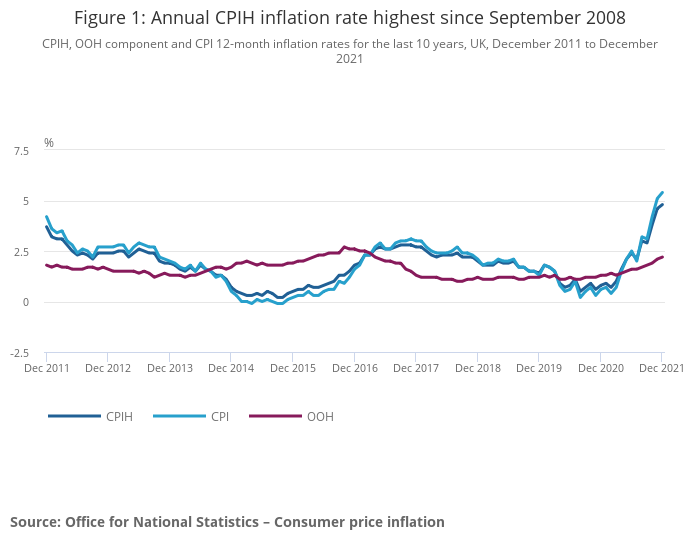

The UK’s official inflation rate has hit 4.8%, up on the previous month and its highest rate since September 2008. Driving the rate are big increases, over the year, in the price of gas and electricity. The largest contribution to the change from last month, however, comes from “food and non-alcoholic beverages”.

Talk over the last year has been about the disruption to the supply of goods services as lockdowns and restrictions hit production and transport, damaging complex supply chains and creating bottlenecks right the way through the system. As economies opened after the initial shock, rapid increases in demand hit these supply chain disruptions, dragging up prices. This is fairly widely accepted amongst economists as an account of why inflation has risen so precipitously, across the world, from early 2021.

But it’s here that the two or three standard stories start to fall apart. For some Keynesians, these supply chain disruptions were only going to be temporary: a rebalancing of the economy, after covid, as the growth restarted. And in the mainstream Keynesian world, if supply was going to quickly expand, increasing demand – for example, by major government spending increases – was nothing to worry about. Many mainstream economists argued that inflation would only be transitory, as a result. They were wrong.

More here.