Herman Mark Schwartz in Phenomenal World:

Herman Mark Schwartz in Phenomenal World:

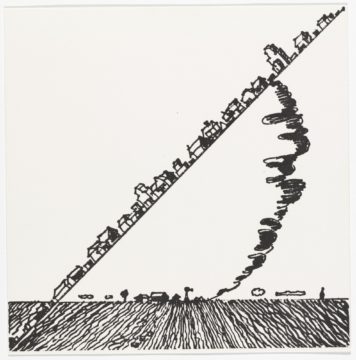

$5.3 trillion of US federal government stimulus and relief spending have returned the economy to its pre-Covid growth trajectory. But that growth trajectory was hardly robust—either before or after the 2008 financial crisis. Nor was the slow decay of GDP growth rates unique to America. In the aggregate, the seven largest rich economies—the G7, composed of the US, Japan, Germany, France, Britain, Italy and Canada—saw growth in real per capita gross domestic product (GDP) slip by more than half from the 1980s to the 2010s.

Economists have called this slowdown “secular stagnation.” Secular stagnation is a seemingly permanent era of slower growth in productivity, investment, and output, and therefore also in per capita income. The Great Depression of the 1930s provoked the first debate about secular stagnation, which pitted John Maynard Keynes and Michał Kalecki against Joseph Schumpeter. The former saw idle workers and idle industrial capacity and called for aggressive fiscal policy and state-directed investment to restore growth. The latter saw idle capacity as evidence of over-investment and too high wages and called for liquidation of struggling firms and cuts in nominal wages.

More here.