Cedric Durand and Adam Tooze debate if and how the current shortfall in energy supply is directly connected to climate policy. First, Durand over at Sidecar:

Cedric Durand and Adam Tooze debate if and how the current shortfall in energy supply is directly connected to climate policy. First, Durand over at Sidecar:

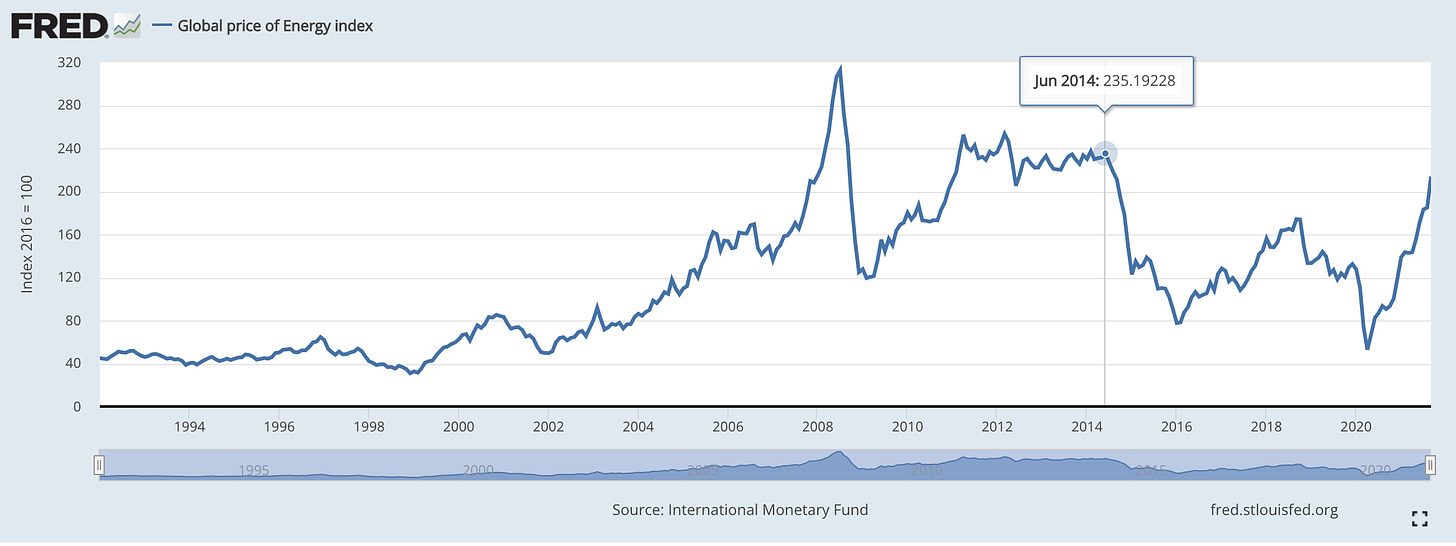

[C]apitalism has already experienced the first major economic shock related to the transition beyond carbon. The surge in energy prices is due to several factors, including a disorderly rebound from the pandemic, poorly designed energy markets in the UK and EU which exacerbate price volatility, and Russia’s willingness to secure its long-term energy incomes. However, at a more structural level, the impact of first efforts made to restrict the use of fossil fuels cannot be overlooked. Due to government limits on coal burning, plus shareholders’ growing reluctance to commit to projects that could be largely obsolete in thirty years, investment in fossil fuel has been falling. Although this contraction of the supply is not enough to save the climate, it is still proving too much for capitalist growth.

Putting together several recent events gives a taste of things to come. In the Punjab region of India, severe shortages of coal have caused unscheduled power blackouts. In China, more than half the provincial jurisdictions have imposed strict power-rationing measures. Several companies, including key Apple suppliers, have recently been forced to halt or reduce operations at facilities in Jiangsu province, after local governments restricted the supply of electricity. Those restrictions were an attempt to comply with national emissions targets by restricting coal-fired power generation, which still accounts for about two thirds of China’s electricity.

Next, Tooze over at Chartbook:

The attraction of this kind of argument for a crisis-theorist of a Marxist bent is obvious. It has about it the ring of a contradiction from which one could then derive a general crisis model. It has also had a surprising amount of currency in the pages of the FT. It is, after all, a plausible-seeming scenario. But, as an account of the 2021 energy crisis it is fundamentally misleading. It attributes far too much influence to climate policy and mistakes the basic dynamics of investment in the sector.

‘[E]nergy dilemma’ can be used to refer more broadly to the crisis tendency of capitalism driven by climate policymaking. That is, a dilemma occurs whenever climate policies hamper economic growth. This includes the direct effects of public regulation on economic actors’ operations (in particular, the impact of climate legislation on production, funding activities and consumption patterns) as well as the indirect effects of policy changes – or anticipated ones – on private investment. These elements are closely intertwined. Since both direct and indirect effects place constraints on the supply-side in terms of rising costs or reduced investment opportunities, their outcomes are similar: a cascading effect on volumes, prices and profitability that impacts growth patterns, either directly or via the financial system.

With this broader interpretation of the energy dilemma – in which both direct and indirect factors contribute to a crisis dynamic unleashed by climate policymaking – much of the evidence cited by Tooze does not contradict my thesis but rather confirms it.