Richard Vague over at INET Economics:

We were drowning in debt before the COVID-19 crisis, and now we are deluged in it.

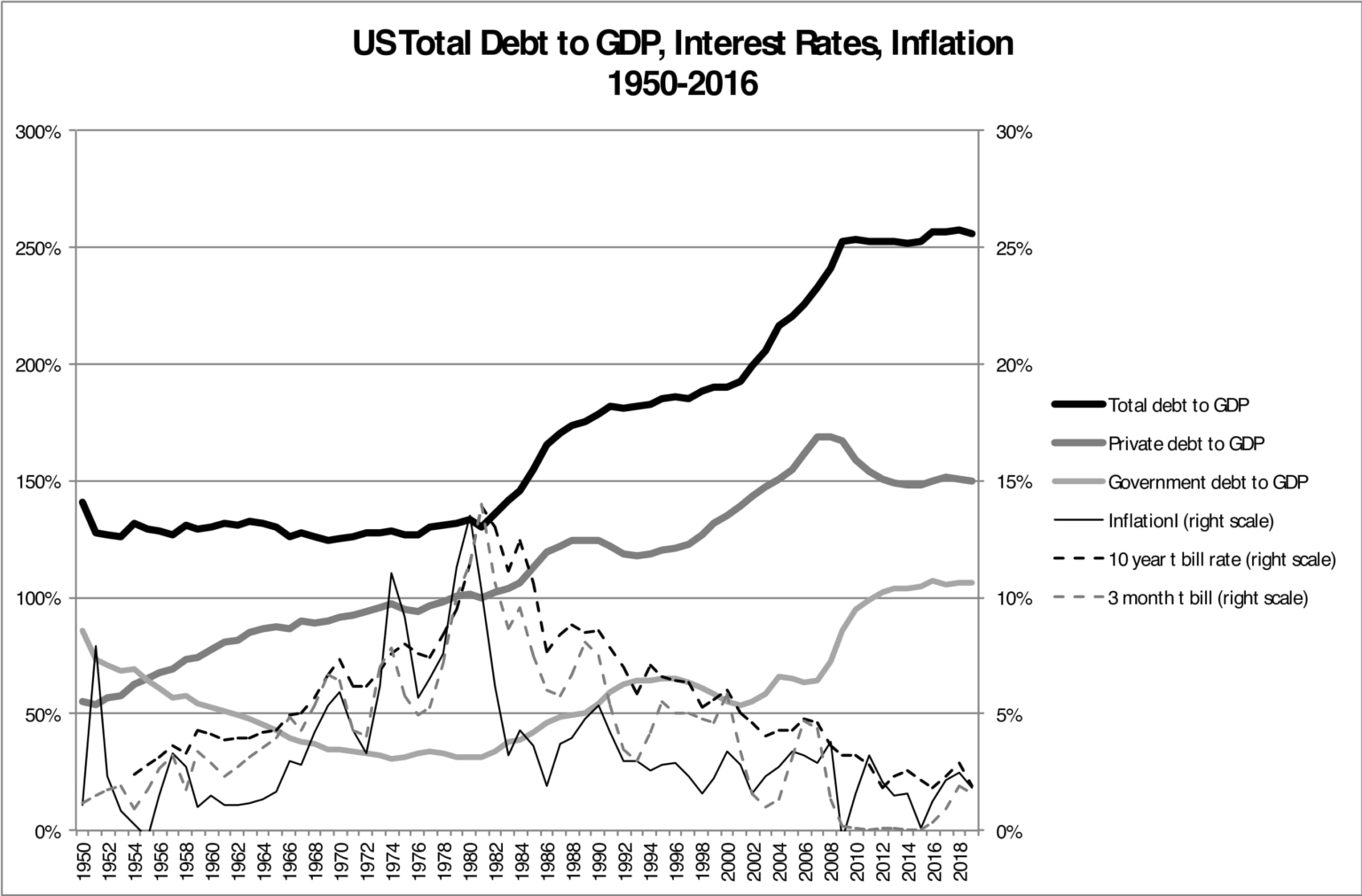

“Total debt” is the sum of public (government) and private-sector debt—and private-sector debt is comprised of business and household debt: for example, student loans, mortgages, auto loans, small business loans, and more. In 1951, total debt stood at 128 percent of our national GDP. By the end of 2019, total debt had doubled to 256 percent. (See Chart 1). Government debt has increased markedly and gets the most attention, but we should be more concerned about the rapid growth in private-sector debt. During this time span, government debt has gone from 74 percent to 106 percent of GDP, but private sector debt has grown even faster, tripling from 54 percent to 150 percent. This debt level burdens individuals and small businesses and stultifies economic growth.

Chart 1

As both the government and American households and businesses use debt to fight the economic collapse caused by the pandemic, these debt ratios continue to spike. From January through May of 2020, private sector debt, which was already far too high, grew from 150 percent to 160 percent of GDP, though it is now moderating—and government debt climbed from 106 percent to 135 percent. By the end of 2021, these numbers could easily rise to over 160 percent and 140 percent, respectively, for a total of 300 percent or more of GDP (see Table A).

More here.