John Wentworth at Less Wrong:

The generalized efficient markets (GEM) principle says, roughly, that things which would give you a big windfall of money and/or status, will not be easy. If such an opportunity were available, someone else would have already taken it. You will never find a $100 bill on the floor of Grand Central Station at rush hour, because someone would have picked it up already.

The generalized efficient markets (GEM) principle says, roughly, that things which would give you a big windfall of money and/or status, will not be easy. If such an opportunity were available, someone else would have already taken it. You will never find a $100 bill on the floor of Grand Central Station at rush hour, because someone would have picked it up already.

One way to circumvent GEM is to be the best in the world at some relevant skill. A superhuman with hawk-like eyesight and the speed of the Flash might very well be able to snag $100 bills off the floor of Grand Central. More realistically, even though financial markets are the ur-example of efficiency, a handful of firms do make impressive amounts of money by being faster than anyone else in their market. I’m unlikely to ever find a proof of the Riemann Hypothesis, but Terry Tao might. Etc.

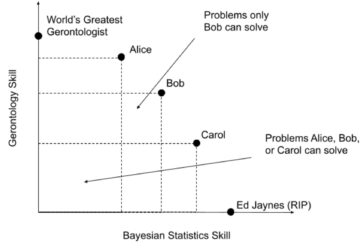

But being the best in the world, in a sense sufficient to circumvent GEM, is not as hard as it might seem at first glance (though that doesn’t exactly make it easy). The trick is to exploit dimensionality.

Consider: becoming one of the world’s top experts in proteomics is hard. Becoming one of the world’s top experts in macroeconomic modelling is hard. But how hard is it to become sufficiently expert in proteomics and macroeconomic modelling that nobody is better than you at both simultaneously? In other words, how hard is it to reach the Pareto frontier?

More here.

Enjoying the content on 3QD? Help keep us going by donating now.